Is It Easy for Women to Get a Business Loan

Women business owners are gaining prominence. According to the Women's Business Enterprise National Council (WBENC), women own 4 out of every 10 businesses in the U.S., totaling 12.3 million. These businesses employ 9.2 million people and generate $1.8 trillion in revenue.

Yet, the barrier for women to start their businesses is still high for various reasons, one of which is that it's a challenge to secure business funding. A report issued by the Federal Reserve Bank of New York notes a gender gap remains when it comes to loan application and approval.

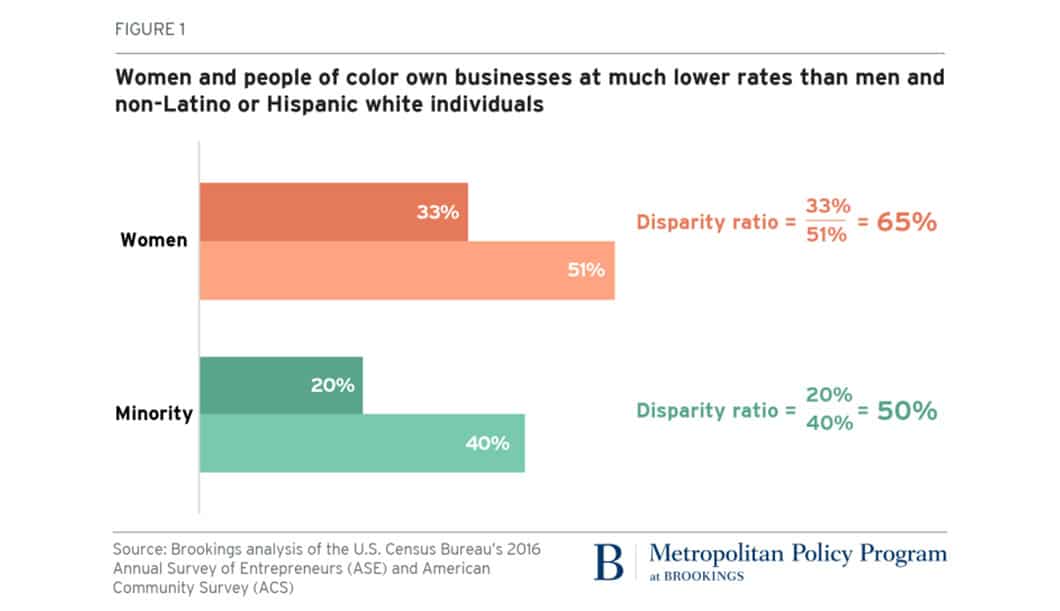

The Metropolitan Policy Program at the Brookings Institution reports women are 51% of the U.S. population, "but only 33% of business owners with employees, a disparity ratio of 65%."

For example, 64% of women-owned firms face a funding gap (compared with 56% of men-owned companies.) Even for those with low credit risk, women business owners are less likely to receive all of the funds they seek.

Why is business funding for women so hard to obtain and how to find the right business loans for women-owned companies?

Why Is It Difficult to Get Business Loans for Women? (And What You Can Do About It)

Here are some of the main reasons why business loans for women are difficult to secure and what you can do to increase your chances of getting an approval.

Risks With Retail

Many women-owned businesses are in the retail sector, which is considered a higher risk by lending institutions.

Regardless of the owner's gender, retailers have lower revenues, higher expenses and lower profit margins than businesses in other industries.

Not Enough Time in Business

Most banks focus on financing profitable businesses because more established organizations have a better chance of repaying the loan. As such, many conventional financial institutions don't accept loan applications from companies that have been in business for less than 2 years.

As you can see, we have another chicken-and-egg problem here. Without the funding, it's much harder to take a business off the ground and stay afloat for 2 years.

You can seek out business loan programs that require less time in business. Some of them also don't require you to show a consistent positive cash flow. In addition, to increase the chances of qualifying for more conventional loans further down the road, you should keep good records so you can show verifiable business history and positive cash flow.

Low Personal Credit Score

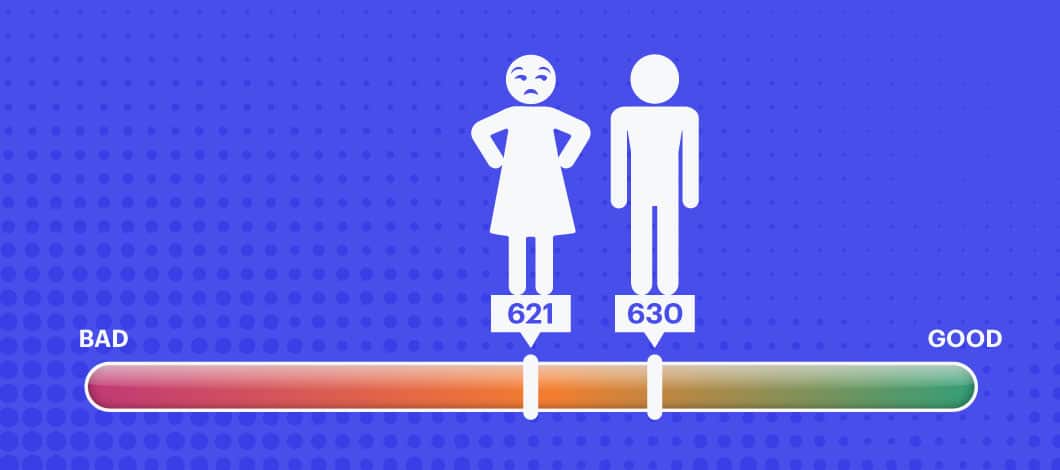

To minimize the risk they take on, lenders tend to reject loan applicants who have less than perfect credit histories. Unfortunately, there's a gender gap when it comes to credit score. Indeed, NBC News reported men have an average credit score of 630 out of a possible 850, while women are at 621.

Why? Women often make less money, according to research by PayScale, a compensation-focused software company. As a result, their credit utilization may be higher — and that negatively impacts creditworthiness. Even if banks don't look at the gender of a loan applicant, the credit score often works against women business owners.

Thankfully, there's an increasing number of lenders that have special programs that offer business loans for women (and men) who have less-than-stellar credit histories. Besides considering those programs, it's never too late to start improving your credit score to make future financing easier.

Lack of Collateral

Bank loans are secured loans, which need to be backed by assets such as real estate properties, equipment, cash savings, etc. Banks consider both business and personal assets in a loan application and tend to undervalue the collateral to minimize their risks.

It's likely that even if you think you have enough collateral to back a loan, your bank may not consider that enough for the amount you're applying for. It's also a challenging decision for women business owners, who tend to be more risk aversive, to put all their assets on the line.

You can consider taking out an unsecured loan, which doesn't need to be backed by collateral. They do require that you have a high credit score and often come with a higher interest rate.

Lower Revenue

Many lenders still tend to regard businesses owned by women to be riskier than ones owned by men. Such a bias can lead to potential discrimination in the loan application review and approval process, lowering the likelihood of women getting business loans.

In addition, WBENC found 88% of women-owned businesses generate less than $100,000 in revenue. A lower revenue or negative cash flow can make a small business appear riskier in the eyes of many lenders and reduces the chances a loan application will be approved.

Your cash flow has a significant impact on how large of a loan payment you can afford. To figure out your current financial position or capacity, get advice from a financial planner who can help you gain perspective and create an action plan to address lacking areas.

Here's more info from our experts to help your small business thrive.

-

What Is Business Collateral? Read article

-

How Commercial Bridge Loans Work (and How They Can Benefit Your Small Business) Read article

Best Business Loans for Women-Owned Businesses

The good news is that with more options available now, it's easier to get startup business funding for women. Your decision will depend on various factors, such as your business's financial profile, credit score, financial needs and business objectives. Here are some options you can consider:

SBA Loans

The U.S. Small Business Administration (SBA) guarantees loans offered through its nationwide network of lending partners. It has several small business loan programs that are popular among women business owners. You also can take advantage of SBA's business guidance and educational resources.

You can borrow up to $5 million through the SBA 7(a) program. There are different types of 7(a) loans, such as the Standard 7(a) Loan, 7(a) Small Loan, SBA Express, Export Express, Export Working Capital and Internal Trade Loan.

The turnaround time for approval is about 5-10 business days. However, if you apply for the SBA Express loan, you can get a response within 36 hours for a loan amount of up to $350,000. You should still expect 60 to 90 days for the funding to be issued.

There's no collateral requirement for loans of less than $25,000. The typical repayment term ranges from 5-10 years and you can take as long as 25 years to repay a loan that's used to finance a real estate purchase.

SBA 7(a) loans tend to offer lower interest rates and give you quite a bit of flexibility in how the money is used. For example, you can use it to cover day-to-day working capital needs, refinance existing business debts, purchase business equipment, buy real estate for the business, purchase inventory or supplies and open a new location.

However, the SBA requires that applicants meet its definition of a small business — generating less than $7.5 million in average annual revenues and staying within specific size guidelines. You also need to have an above-average credit score, meanwhile a history of bankruptcies or foreclosure may hurt your chances of getting approved. If you own 20% or more of your business, you'll need to have an unlimited personal guarantee.

Bank and Credit Union Loans

Many banks and credit unions are becoming friendlier toward women-owned businesses. In particular, credit unions often offer some good options because they focus on serving local businesses and communities.

Credit unions are not-for-profit financial institutions, which issue loans that are often lower in interest rates. You may have a better chance of getting approved for a personal loan from credit unions than from large banks because they have more flexibility in adjusting the terms and requirements based on your circumstances.

This type of loan often has fixed interest rates and can be tailored to meet your financing needs. If you have a personal or business banking relationship with the institution, you may be able to negotiate better terms. Taking out a bank loan and repaying it on time also can help you build your business's credit rating, making it easier to apply for other loans in the future.

However, you do need to have a good to excellent credit score to get approved and take advantage of the lower interest rates so it'd be more challenging if you don't have strong credit or verifiable business history. Lastly, the approval process often requires time-consuming paperwork. It may take several weeks or even months because you get your funding, making it a less-than-ideal option if you need the money right away.

Online Business Loans

There's an increasing number of alternative lenders offering small business loans online. These loans are often more accessible to women business owners because of less stringent requirements. Many also address the common challenges faced by women small business owners, such as lower credit scores or less conventional business models.

There are different types of business loans available, including:

- Working capital loans, which can be used for short-term, day-to-day expenses so you can run your business without tapping into your cash flow. You can use the money to pay your employee, cover rent, and manage overhead costs.

- Equipment loans are used for purchasing new computers, office supplies, or the machinery you need to manufacture your products.

- Inventory loans are for businesses that sell physical products (e.g., retail) to keep your shelves stocked.

- Term loans are to be repaid over a specific timeframe. Short-term loans often need to be repaid within a few months and long-term loans are repaid over a few years. They carry a fixed interest rate, which gives you more predictability with the payments.

Many of these online lenders also offer funding options that aren't technically loans but can be helpful to many women business owners, including merchant cash advances, invoice financing and business line of credit.

Online business loans are ideal if you need funding quickly. Some lenders can approve a loan in 24-48 hours and complete the funding in a few days. Some online lenders also reduce the many fees involved, such as origination fees or prepayment penalties so you can lower the cost of borrowing. The borrowing limits and repayment terms are typically more generous and, in many cases, collateral is not required.

Interest rates from online lenders tend to be slightly higher than traditional bank loans. Also, online business lending is less mature and lenders that go out of business can cause significant hassles for their customers. As such, you should take the time to research your options and select a well-established lender.

Microloans

These smaller loans are typically $50,000 or less. It's a good option if you're just starting out, have a smaller capital need or run your business as a sole proprietor. You can look into SBA's microloan program, which provides funding to small businesses through non-profit, community-based organizations.

Besides SBA, you can find other organizations that offer microloans to small businesses. Some of these lenders specialize in providing business funding for black women and other minority business owners. For example, the Business Center for New Americans (BCNA), the Minority and Women Revolving Loan Trust Fund Program and the Business Consortium Fund Loan (BCF).

It's easier to obtain a microloan, which often doesn't require a high credit score or collateral. However, there are more limitations on how these loans can be used. For instance, they can't be used to purchase real estate or refinance other business loans.

Getting Funding for Women-Owned Small Businesses

To increase the chances that you're approved for a business loan now or in the future, you should keep good records and build up your personal and company's creditworthiness:

- Improve your personal and business credit scores

- Keep good records on the length of time in business

- Document your annual revenues and business debts

- Organize your financial statements and tax return documents

- Maintain proof of your cash assets and collateral

- Create a comprehensive business plan and update it regularly

While it's still challenging for women-owned businesses to get funding, there are more resources and guidance than ever to help you realize your dream. Besides conventional loans, you can explore angel investment, venture capital funding and even crowdfunding to help finance your business.

Also, don't hesitate to ask for help. Many organizations provide guidance to women entrepreneurs, such as the Office of Women's Business Ownership, the National Association of Women Business Owners and the National Women's Business Council, from which you can access the latest funding and business resources to help you take your business to the next level.

flinchumstren1944.blogspot.com

Source: https://www.fastcapital360.com/blog/why-difficult-to-get-business-loans-for-women-entrepreneurs/

Post a Comment for "Is It Easy for Women to Get a Business Loan"